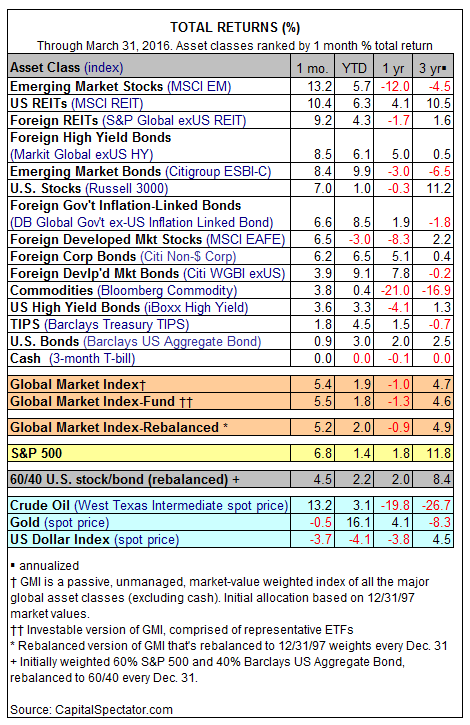

Global markets snapped back sharply in March, posting the first run of across-the-board monthly gains for the major asset classes in nearly two years. Leading the markets higher: emerging-market stocks (NYSE:EEM), which surged more than 13% last month—the biggest monthly advance in years for the index. Even the persistent bear market in broadly defined commodities had a reprieve in March—the Bloomberg Commodity gained nearly 4%.

The March rebound has made an impact on longer return windows too. For instance, nearly all corners of global markets are now in the black for year-to-date comparisons through the end of 2016’s first quarter and the incidence of red ink has made a conspicuous retreat in the one-year column relative to February’s bearish profile.

The widespread gains translated into a strong increase in March for the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights. Last month’s 5.4% rise is the biggest monthly pop in more than four years. Meantime, the latest burst boosted GMI’s trailing three-year performance to the highest level in recent history—a nearly 5% annualized total return.

The question, of course, is whether the powerful revival in the risk-on trade for last month marks a new bull phase for markets—or a temporary bounce in an ongoing bear market? No one knows, but for the moment the rear-view mirror is offering a new excuse to think positively.